Business reporter, BBC News

BBC

BBCChancellor Rachel Reeves has refused to rule out long term tax rises after the United Kingdom economic system suffered its worst contraction for a yr and a part in April.

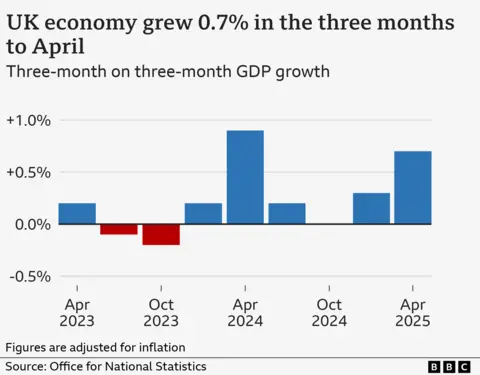

The economic system hastily shrank by means of 0.3% after taxes larger for companies, family expenses jumped and exports to the United States plunged.

The figures come an afternoon after Reeves set out spending plans aimed toward boosting expansion, with investment will increase for the NHS and defence, however budgets squeezed somewhere else.

Economists warned {that a} failure to extend UK expansion would “almost certainly” result in extra tax rises later this yr for the federal government to steadiness its spending commitments.

Reeves stated the newest financial figures had been “clearly disappointing” and refused to rule out tax rises when she subsequent lays out her plans for the economic system within the autumn Budget.

“No chancellor is able to write another four years of Budgets within a first year of government, you know how much uncertainty there is in the world at the moment,” she instructed the BBC.

Monthly figures at the economic system are unstable, and the extra solid three-month determine to April confirmed the economic system grew by means of 0.7%.

“With spending plans set… any move in the wrong direction will almost certainly spark more tax rises,” mentioned Paul Johnson, director of the Institute for Fiscal Studies (IFS), an influential assume tank.

Ruth Curtice, leader government of the Resolution Foundation, agreed.

“A weaker economic outlook and the unfunded changes to winter fuel payments mean the chancellor will likely need to look again at tax rises in the Autumn,” she mentioned.

In Wednesday’s Spending Review, Reeves prioritised ploughing billions into long-term tasks, in a bid to spice up financial expansion and toughen residing requirements.

But most of the chancellor’s plans akin to new railway strains and the construction of nuclear energy plant Sizewell C will take years, with present day by day spending budgets being squeezed.

Council tax may be anticipated to upward thrust to pay for native products and services.

Opposition events mentioned the chancellor’s earlier choice to boost employers’ National Insurance contributions, which took impact in April, used to be dragging on expansion.

The govt may be paying extra to borrow cash.

Lindsay James, funding strategist at British multinational wealth control corporate Quilter, mentioned this used to be because of buyers being cynical over the federal government’s spending plans so hard the next go back.

“With the economy now weakening, we can expect to see concerns around further tax rises increase as we near the autumn Budget – which is likely to weigh on growth even more.”

Growth emerging continuously is extensively welcomed, because it generally way individuals are spending extra, further jobs are created, extra tax is paid, and staff recover pay rises.

But expansion in the United Kingdom has been slow for a few years.

The Office for National Statistics mentioned a deficient month for the products and services sector, which incorporates companies starting from stores and eating places to hairdressers and monetary companies, used to be in the back of the contraction in April.

Legal companies and belongings firms additionally “fared badly”, it mentioned, following a robust March which noticed many homebuyers speeding to finish purchases to keep away from stamp responsibility will increase that got here in in April.

Lewis Eager, 26, works part-time for a grocery store in Southend-on-Sea, incomes about £10,000 a yr.

He welcomed the funding in apprenticeships introduced within the Spending Review and hopes employers will reply by means of reducing limitations to candidates.

Lewis, who lives together with his folks, estimated he had carried out for greater than 4,000 jobs however mentioned he can’t in finding full-time paintings.

He mentioned he sees a “looming crisis” amongst younger folks not able to get at the jobs ladder.

Tariff affect

Car production used to be additionally vulnerable in April after the advent of 25% price lists on UK automobiles exported to the United States. Cars are the United Kingdom’s largest US export, with one in 8 vehicles inbuilt Britain shipped around the Atlantic.

Trade information confirmed the worth of UK exports diminished by means of some £2.7bn in April, with items to America by myself falling by means of £2bn, the biggest per month fall on report in exports around the Atlantic.

Since April, the federal government has agreed a deal on price lists with the United States and has additionally made business agreements with the European Union and India.

Despite the tariff pact with the United States, a 10% import tax nonetheless applies to maximum UK items coming into America, with upper taxes for metal and vehicles till the deal comes into drive.

‘More taxes coming’

Shadow chancellor Mel Stride blamed Reeves’ financial alternatives for the vulnerable expansion.

“The chancellor should have taken corrective action to fix the problems she has caused. But instead her Spending Review has all but confirmed what many feared: more taxes are coming.”

Liberal Democrat Treasury spokesperson Daisy Cooper mentioned the figures had been a “wake-up call for the government which has so far refused to listen to the small businesses struggling to cope with the jobs tax”.

In April, employers’ National Insurance contributions rose to 15% from 13.8%, with the brink for bills decreased from £9,100 in line with yr to £5,000.

Firms additionally noticed minimal wages and industry charges move up.

Ollie Vaulkhard, director of Vaulkhard Group which owns 17 hospitality venues throughout Newcastle upon Tyne, mentioned the industry used to be beneath force from the associated fee will increase.

“Each one of those is manageable – you put them all into a pot, ultimately we’ve got to charge our customers more,” he mentioned.

Global News Post Fastest Global News Portal

Global News Post Fastest Global News Portal