Business reporter, BBC News

Getty Images

Getty ImagesA upward push in the price of family expenses has driven UK inflation to its very best price in additional than a yr.

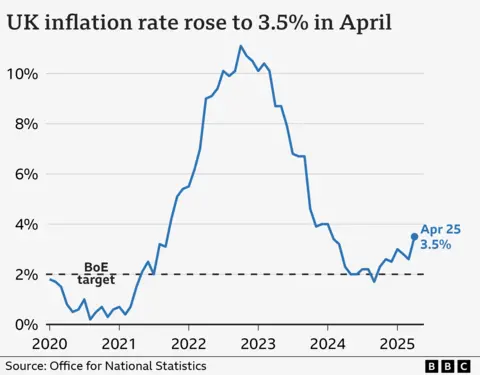

Inflation was once 3.5% in April, up from 2.6% in March, in line with reliable information.

Water, gasoline and electrical energy costs all went up on 1 April at the side of a number of different expenses, pushing inflation additional above the Bank of England’s goal of 2%.

The biggest upward individuals to the upward push have been from “housing and household services, transport, and recreation and culture,” the Office for National Statistics stated.

April’s price of inflation is upper than economists had predicted.

The tempo of value rises was once forecast to be round 3.3%.

The Bank of England has in the past stated it expects inflation to spike at 3.7% between July and September 2025 earlier than losing again to its 2% goal.

In April, families have been hit by means of sharp rises in power and water expenses, and – to a lesser extent – upper meals costs. Firms have been additionally hit by means of upper prices – a upward push in employer National Insurance contributions and a better minimal salary.

The ONS says costs of water and sewerage rose by means of 26.1% in April, which it stated is the biggest upward push since a minimum of February 1988.

It’s a mixture of the ones components that has pushed inflation upper.

Meanwhile, the price of facilities rose 5.4% within the yr to April, which economists stated was once because of adjustments to National Insurance Contributions for employers and better minimal salary getting into pressure.

Services inflation refers to rises in costs for facilities like consuming at a cafe, getting a haircut, or going to the cinema.

Britain is a services-led economic system this means that that extra of our jobs come from offering a provider relatively than creating a product.

Grant Fitzner, performing director basic of the ONS, stated: “Significant increases in household bills caused inflation to climb steeply.

“Gas and electrical energy expenses rose [in April] in comparison with sharp falls similtaneously final yr because of adjustments to the Ofgem power value cap.”

Chancellor Rachel Reeves said she was “disillusioned” with the figures and cited April’s minimum wage rises and the decision to freeze fuel duty as helping pepole with the cost of living pressure.

Mel Stride, shadow chancellor, said the figure “is being worried for households”.

“We left Labour with inflation bang heading in the right direction, however Labour’s financial mismanagement is pushing up the price of dwelling for households,” he added.

Paul Dales, chief UK economist at Capital Economics, said: “These figures will make the Bank extra alert to the chance that this rebound in inflation will likely be larger and last more than it have been considering.”

The rise means the Bank of England governor – whose job is to keep inflation at its target of 2% – will have to write a letter to the chancellor.

One of the Bank’s key tasks is to keep inflation at 2% and it cuts or raises interest rates to achieve that.

They will need to explain why inflation has risen more than 1% over this and what the plan is to get the inflation rate back to 2%.

‘Supermarket shop is getting more and more expensive’

Tracy McGuigan-Haigh, 47, lives with her 11-year-old daughter Ruby in Dewsbury and works in retail.

She has to fit her working hours around looking after Ruby and receives universal credit on top of her wage. She says her monthly income isn’t stretching far enough.

“Even on the cheap, the grocery store store is getting increasingly more pricey. I’m now not popping out with so much in my hands.

“Before, I’d have needed a trolley for £40 worth of food. Now it doesn’t even fill a basket – you can carry that much in your arms.”

She says the price of on a regular basis pieces is “killing” her and does not imagine any long term fall in rates of interest will make a distinction.

“It’s gone too far. I’ve juggled so much that I’ve dropped balls, and somebody’s going ‘it’ll get better’. But, even if it does improve now, what’s the support for the people who are down there, who are on the floor?”

Global News Post Fastest Global News Portal

Global News Post Fastest Global News Portal