Financial investigations correspondent

Bloomberg by way of Getty Images

Bloomberg by way of Getty ImagesThe Supreme Court is poised to rule at the instances of 2 former City investors jailed for rigging rates of interest, amid issues raised by way of senior politicians that there could have been a sequence of miscarriages of justice.

If the investors are a success of their utility – which is adverse by way of the Serious Fraud Office (SFO) – it would result in the quashing of all final convictions secured in 9 legal trials.

Tom Hayes, a former dealer on the Swiss financial institution UBS, become the first banker to be jailed for “rigging” rates of interest in August 2015.

He was once accused on the age of 35 by way of the United States Department of Justice and the Serious Fraud Office of being a “ringmaster” of a world fraud conspiracy and sentenced to 14 years in prison.

Together with former Barclays dealer Carlo Palombo, he’s now waiting for a an important Supreme Court judgement.

Hayes and Palombo have been amongst 37 City investors prosecuted for “manipulating” the rate of interest benchmarks Libor and Euribor, which observe the price of borrowing money between the banks and are used to set the rates of interest on tens of millions of mortgages and business loans.

In legal trials on each side of the Atlantic from 2015 to 2019, 19 have been convicted of conspiracy to defraud and 9 have been despatched to prison.

Reuters

ReutersAs they served time, proof emerged that central bankers and govt officers internationally, together with a best adviser at 10 Downing Street on the time, had careworn banks comparable to theirs to have interaction in very equivalent behavior to what they have been jailed for – however on a miles larger scale.

No central banker or govt reputable was once prosecuted.

Then, quickly when they have been launched after serving their complete prison price lists, a US enchantment court docket determined such behavior wasn’t against the law in any case; nor even towards any regulations.

The US Department of Justice revoked the costs towards Tom Hayes, and america courts then threw out all equivalent convictions.

Yet in the United Kingdom, they continue to be convicted criminals.

The Serious Fraud Office, which prosecuted the instances, says the defendants have been convicted of conspiracy to defraud and issues to a lot of earlier unsuccessful makes an attempt to overturn convictions on the Court of Appeal.

The Supreme Court’s now being requested to make a decision if judges have been flawed to inform juries their behavior was once illegal.

If it does so, it would result in the overturning of all final convictions, throwing an international 17-year scandal into opposite.

It’s additionally prone to instructed renewed requires a public inquiry into proof of a lot greater rate of interest “rigging” – ordered from the highest of the monetary device by way of central banks and governments international.

This is the primary time the instances have reached the Supreme Court following public drive from senior politicians, together with former shadow chancellor John McDonnell and previous Brexit Secretary David Davis.

They have advised the BBC they are involved the investors were “scapegoated” in a scandalous sequence of miscarriages of justice that runs “deeper than the Post Office”.

They desire a public inquiry.

What is Libor ‘rigging’?

What the FTSE 100 or the Dow Jones are to proportion costs, Libor is to rates of interest: an index, up to date each day, that tracked the price of borrowing money between the banks from 1986 till 2024.

Each day at 11am, 16 banks throughout London would resolution a query: at what rate of interest may they borrow cash?

Before answering, investors at the banks’ money desks would take a look at the variety of rates of interest at which different banks available on the market have been providing to lend money, which generally differed from each and every different by way of only one or two hundredths of a share level (e.g. HSBC providing to lend budget at 3.14%, Bank of China at 3.16%, JP Morgan at 3.15%).

Each financial institution would then make a choice a charge from that vary of provides to publish as their resolution.

An reasonable would then be taken to get the reputable benchmark, Libor (London Interbank Offered Rate).

A equivalent procedure was once used to get Euribor, the an identical of Libor for euros.

The proof towards Hayes and Palombo have been messages that they had despatched to the money investors asking them to choose a ‘top’ or ‘low’ charge from that vary, relying on what could gain advantage their banks’ trades – which went up or down in price connected to Libor (or Euribor).

Their requests would possibly make no distinction to the common; or they could nudge it very quite of their financial institution’s favour – up or down by way of no a couple of 8th of 1 hundredth of a share level (0.00125%).

But it was once noticed as definitely worth the effort of constructing the requests, which have been trade follow for years, in case it could lend a hand their financial institution earn more money or lose much less.

Prosecutors alleged Hayes was once dishonestly in search of to govern the Libor charge to learn the financial institution’s buying and selling positions and subsequently his bonuses whilst “cheating” others buying and selling available on the market, “motivated by pure greed”.

The SFO accused Palombo of being a “crook” and a “cheat” who had “left his moral compass at home”.

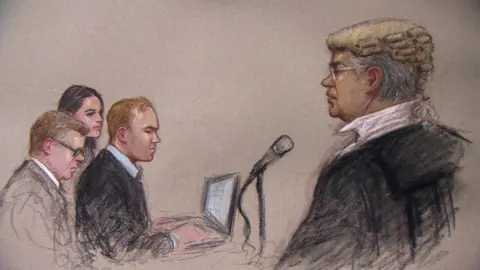

Julia Quenzler for BBC

Julia Quenzler for BBCThe investors protested that any attainable positive factors to their bonuses from a nudge to Libor of a most 0.00125% have been a ways too little to inspire a legal conspiracy.

What they noticed because the clerical job of opting for ‘top’ or ‘low’ charges in response to the economic pursuits of the financial institution – was once simply what each financial institution had carried out because the 1980s, lengthy prior to they began paintings.

But consistent with the SFO, it was once rate of interest “manipulation” that amounted to proof of a world conspiracy to defraud.

At his 2015 trial, Hayes mentioned he had no longer requested for any false solutions to be given to the Libor query – however simply attempted to verify his financial institution decided on a commercially effective charge from the variety of correct rates of interest at which it would in reality borrow.

But the pass judgement on, Mr Justice Jeremy Cooke, determined that any try to have in mind business pursuits when filing a Libor charge was once “self-evidently” illegal.

Sentencing Hayes to 14 years, he disregarded the argument that it was once City follow.

“The fact that others were doing the same as you is no excuse, nor is the fact that your immediate managers saw the benefit of what you were doing and condoned and embraced it, if not encouraged it.[…] The conduct involved here must be marked out as dishonest and wrong and a message sent to the world of banking accordingly.”

The defendants say court docket rulings retrospectively criminalised no longer most effective their movements years prior to, but additionally the ones of senior bankers and civil servants, a lot upper up the monetary pecking order, who had sought to steer Libor on a miles larger scale.

Audio recordings, paperwork and information exposed by way of the BBC point out that within the 2008 monetary disaster, governments and central banks from the Bank of England to the Banque de France and Banca d’Italia careworn banks to push Libor and Euribor down artificially as a way to make actual rates of interest seem not up to they have been and quell hypothesis about banks’ solvency – a extremely business reason.

The distinction, even though, was once that while the investors have been inquiring for shifts of 1 hundredth of a share level, the central banks sought strikes as much as 50 instances the dimensions, giving charges that have been clearly false, a ways clear of the variety of rates of interest the place money was once being borrowed or lent at the cash markets.

In a BBC Radio 4 podcast sequence exposing the scandal, The Lowball Tapes, Palombo asks despairingly, “If that’s not criminal, how can I be a criminal?”

Reuters

ReutersContemporary emails and get in touch with transcripts, reputable interviews by way of the FBI and first-hand accounts of witnesses level to the involvement of best officers at Downing Street and the Treasury.

They weren’t proven to the juries on the investors’ trials.

Palombo describes his existence since being prosecuted as a “Kafka nightmare” the place he may slightly perceive the accusations made towards him, and not using a sense of getting carried out anything else even vaguely flawed.

To him and to Hayes, some of the severe implications is that what took place to them may occur to someone within the office – to them, if customary business follow will also be retroactively criminalised, no-one can ensure that the day-to-day duties they are these days engaged in at paintings may not, in future years, be condemned and prosecuted.

The Treasury has mentioned it didn’t search to steer particular person financial institution Libor submissions.

The Bank of England has mentioned Libor was once no longer regulated on the time. The Banque de France, Banca d’Italia and the Federal Reserve have declined to remark.

In the investors’ instances the Court of Appeal, led by way of judges together with Lord Chief Justice John Thomas and Lord Justice Nigel Davis, blocked the trail to the Supreme Court 5 instances from 2015 to 2019.

In 2021, the Criminal Cases Review Commission (CCRC) to begin with mentioned it might flip down Hayes’s utility.

But then in January 2022 a US enchantment court docket absolutely acquitted two former Deutsche Bank investors, Matt Connolly and Gavin Black, pronouncing prosecutors had failed to provide any proof that they had requested for false charges to be submitted at which their banks may no longer borrow.

Getty Images

Getty ImagesAll US convictions for ‘rigging’ Libor have been due to this fact thrown out.

The pair had to begin with been convicted in 2018 on equivalent fees to Hayes and Palombo.

The following yr, the CCRC was once persuaded to switch its thoughts.

In 2024, Court of Appeal judges qualified, for the primary time in those instances, that there was once some extent of legislation of common public significance at stake, after all clearing the trail to the Supreme Court.

Two months in the past, the Supreme Court heard arguments that judges within the decrease courts had advised juries that Hayes and Palombo’s requests have been flawed as an issue of legislation – when it will have to were left as an issue of reality for the jury to make a decision.

The SFO advised the court docket the defendants did not problem the jury instructions on the time.

Hayes and Palombo now look ahead to the Supreme Court’s judgement.

Global News Post Fastest Global News Portal

Global News Post Fastest Global News Portal

&w=310&resize=310,165&ssl=1)

&w=310&resize=310,165&ssl=1)

&w=310&resize=310,165&ssl=1)