Introduction: US business with China weakening

Good morning, and welcome to our rolling protection of industrial, the monetary markets and the arena financial system.

Donald Trump’s business conflict is weakening the United States financial system and inflicting a plunge in business with China, economists and logistics companies are caution.

Nearly 4 week’s after Trump’s ‘Liberation Day’ announcement of upper price lists brought on a business conflict with Beijing, proof is mounting that companies and customers are chopping again.

Torsten Sløk, leader govt at asset supervisor Apollo Global Management, explains:

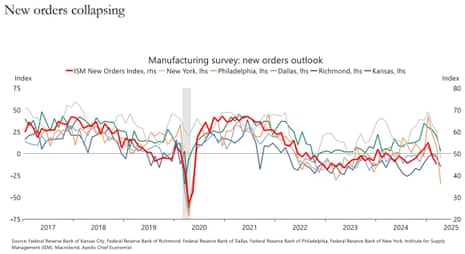

For firms, new orders are falling, capex plans are declining, inventories have been emerging sooner than price lists took impact, and corporations are revising down profits expectancies.

For families, client self assurance is at record-low ranges, customers have been front-loading purchases sooner than price lists started, and tourism is slowing, specifically global shuttle.

Sløk has pulled in combination a chartbook highlighting the wear and tear to corporate profits…

…on new orders…

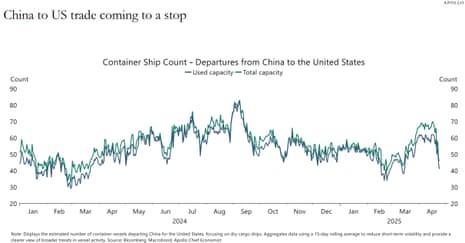

…and particularly on business with China.

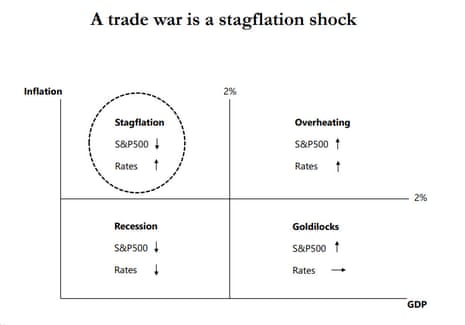

A business conflict is a “stagflation shock”, Sløk fears.

He explains that it most often takes between 20 and 40 days for a sea container to shuttle from China to the United States. That implies that the slowdown in container departures from China to the United States which began in early April can be felt at US ports in early and mid-May.

That would hit call for for trucking from mid-May, main to drain cabinets and layoffs in trucking and retail business, inflicting what Sløk dubs “The Voluntary Trade Reset Recession”.

Sløk warned on Friday:

In May, we will be able to start to see important layoffs in trucking, logistics, and retail — specifically in small companies corresponding to your impartial toy retailer, your impartial ironmongery shop, and your impartial males’s outfitter.

With 9 million other folks operating in trucking-related jobs and 16 million other folks operating within the retail sector, the drawback dangers to the financial system are important.

There are indicators these days that this business slowdown is underway, because of the 145% tariff imposed on Chinese imports to the United States.

The Financial Times experiences this morning that the Port of Los Angeles, the primary path of access for items from China, expects scheduled arrivals within the week beginning 4 May to be a 3rd less than a 12 months sooner than.

The new upper price lists introduced on different international locations are these days paused, in fact, whilst the United States negotiates new business offers.

Trump has claimed to Time Magazine that he’s made 200 offers. But this seems to be, neatly, an exaggeration.

US Treasury secretary Scott Bessent instructed ABC News he believes Trump is “referring to sub deals within the negotiations we’re doing.”

Bessent insisted, although, that growth is being made, arguing:

If there are 180 international locations, there are 18 necessary buying and selling companions, let’s put China to the aspect, as a result of that’s a unique negotiation, there’s 17 necessary buying and selling companions, and now we have a procedure in position, over the following 90 days, to barter with them. Some of the ones are shifting alongside rather well, particularly with the Asian international locations.

Treasury Secretary Scott Bessent defended President Donald Trump’s negotiating technique on business offers however mentioned he did not know whether or not Trump was once talking without delay with Chinese President Xi Jinping. https://t.co/kOqQ2STvOf

— ABC News (@ABC) April 27, 2025

Last week, transport large Hapag-Lloyd reported that its shoppers have cancelled 30% of shipments to the United States from China….and there was a “massive increase” in call for for consignments from Thailand, Cambodia and Vietnam as a substitute.

The schedule

-

11am BST: CBI’s distributive trades survey of UK retailing

-

11am BST: France’s unemployment information for March

-

3.30pm BST: Dallas Fed production index for April

Key occasions

China’s overseas ministry says Xi and Trump have no longer spoken just lately

Back in Beijing, China’s overseas ministry has mentioned President Xi Jinping had no longer spoken to Donald Trump.

The ministry additionally denied that the 2 administrations are in talks to strike a tariff deal, which contradicts a declare from Trump remaining week.

Guo Jiakun, a ministry spokesperson, instructed a press convention:

“As some distance as I do know, the 2 heads of state have no longer known as every different just lately,

“I want to reiterate that China and the U.S. have no longer carried out consultations or negotiations at the price lists factor.

“If the U.S. really wants to solve the problem through dialogue and negotiation, it should stop threatening and blackmailing (China).”

Last Friday, Time Magazine reported that Trump had instructed them remaining week that his management is speaking with China to strike a tariff deal and that Chinese President Xi Jinping had known as him.

M&S ‘tells loads of company team of workers to not come to paintings’

Sky News are reporting that loads of company team of workers at Marks & Spencer’s primary clothes and residential warehouse within the East Midlands had been instructed to not are available in.

That highlights the disruption being motive through the massive M&S cyberattack, which has resulted in the suspension of on-line orders remaining week.

Exclusive: Marks & Spencer has instructed loads of company employees at its massive Castle Donington distribution centre within the East Midlands to not come into paintings as Britain’s best-known store grapples with the unfolding have an effect on of a significant cyberattack. https://t.co/hBK3eUvbiU

— Mark Kleinman (@MarkKleinmanSky) April 28, 2025

Goldman Sachs: equities are in a undergo marketplace

Goldman Sachs analysts stay wary in regards to the outlook for stocks, although.

In a brand new analysis be aware these days, Goldman say they “continue to see equities as in a bear market”, because of the possibility of increased business uncertainty and weaker financial task.

The fairness marketplace is these days pricing a enlargement outlook above Goldman economists’ baseline forecast, they are saying, bringing up the restoration within the pan-European Stoxx 600 index:

Despite the uncertainty, the STOXX 600 is up 3% year-to-date, having rebounded through 11% from its contemporary trough. Looking on the efficiency of Cyclicals as opposed to Defensives, we discover that the European fairness marketplace is these days pricing Euro house GDP enlargement of roughly 1.5%.

This is upper than our economists’ forecast for Euro house actual GDP enlargement of 0.7% in 2025.

FTSE 100 on course for 11th upward push in a row

Britain’s inventory marketplace is on course to check its longest run of beneficial properties in 8 years.

The FTSE 100 index has risen through 20 issues, or 0.25%, in early buying and selling to 8436 issues. That places the blue-chip stocks index on course for its 11th day-to-day upward push in a row, a listing remaining set in December 2019 after Boris Johnson’s election win.

The FTSE 100 remaining set an extended successful run from late-December 2016 to mid-January 2017, when it rose for 14 days at the trot.

The restoration over the previous few weeks has been helped through the United States pausing a lot of its price lists on buying and selling companions (tho no longer China)

These contemporary beneficial properties have no longer totally recovered the losses after Donald Trump’s announcement of latest world price lists, although, as this chart presentations:

For April as an entire, the FTSE 100 continues to be down 1.7%.

M&S stocks drop once more as cyber disruption continues

Marks & Spencer are main the FTSE 100 fallers this morning, because it reels from the wear and tear led to through a cyber assault.

Shares in M&S are down 2.3% this morning at 376p, as buyers digest the continuing disruption on the corporate.

On Friday it halted all orders via its web site and apps, and inspired shoppers to talk over with its retail outlets as a substitute.

The cyber incident started per week in the past, on Easter Monday, affecting contactless bills and click-and-collect orders in retail outlets throughout the United Kingdom. M&S disclosed it on Tuesday, pronouncing a “cyber incident” affected contactless bills and the pick out up of on-line orders in its retail outlets in contemporary days.

Shares in M&S have dropped through over 8% since then, having closed at 411p sooner than Easter.

Susannah Streeter, head of cash and markets at Hargreaves Lansdown, says the continuing issues underline how tough the breach has been to get a maintain on.

Streeter issues out that the suspension of on-line orders can be massively destructive for gross sales, including:

Marks and Spencer’s contemporary run of luck has been partially right down to the way it been so environment friendly at managing its multi-channel operations with click on and bring together services and products specifically well-liked.

It’s been lowering its retailer footprint that specialize in smaller meals retail outlets the place shoppers can swing purchase and pick out up merchandise purchased on-line. This ease of buying groceries and supply has been upended. Even although retail outlets are open, many merely don’t inventory the preferred levels from on-line.

Fashion gross sales are more likely to take a large hit specifically because the assault has come all over the spell of heat climate when summer time levels would ordinarily be piling up in digital baskets. While different shops have no longer been proof against IT breaches, the intensity of Marks and Spencer’s issues in resolving the problem are being concerned, and it should take a while to win again some extra warier consumers.

Deliveroo stocks soar 17% after DoorDash takeover means

Shares in meals supply crew Deliveroo have jumped through 17% firstly of buying and selling in London, after receiving a takeover means from US rival DoorDash.

On Friday night time, the inside track broke that DoorDash had presented to shop for Deliveroo for $3.6bn (£2.7bn).

Deliveroo mentioned that won an indicative proposal from DoorDash for a imaginable money be offering price 180p in keeping with proportion, and that it could be “minded to recommend such an offer to Deliveroo shareholders”.

Its stocks have jumped to 170p this morning….

This morning, Deliveroo additionally introduced that it has suspended its £100m proportion buyback programme, because of the means from DoorDash.

DoorDash’s hobby comes 4 years after Deliveroo floated at the London inventory marketplace, in what has been known as the City’s worst IPO ever.

Deliveroo’s stocks have been priced at 390p every, however slumped through 1 / 4 at the first day of buying and selling – inflicting the company to be dubbed “Flopperoo”.

The Times issues out these days that if the DoorDash deal is going via at 180p, Deliveroo founder Will Shu would obtain a payout of greater than £172m, primarily based upon his 5.9% stake

UK enlargement forecast to sluggish sharply as Trump price lists hit financial system

Mark Sweney

The UK financial system is about to sluggish sharply for the following two years as Donald Trump’s world tariff conflict weighs on client spending and trade funding, a find out about through a number one forecaster has predicted.

The EY Item Club is now forecasting that UK gross home product (GDP) will develop through 0.8% this 12 months, down from a projection of 1% in February, and has reduce its 2026 forecast from 1.6% to 0.9% as longer-term results hit the United Kingdom.

Bloomberg: Shein hikes US costs through as much as 377%

American shoppers of fast-fashion large Shein are actually feeling the have an effect on of the business conflict.

Shein raised the United States costs of a swathe of goods on Friday, Bloomberg reported, in anticipation of latest price lists on small parcels.

Over to Bloomberg for the main points:

The reasonable value for the highest 100 merchandise within the health and beauty class greater through 51% from Thursday, with a number of of the pieces greater than doubling in value.

For house and kitchen merchandise and toys, the common soar was once greater than 30%, led through an enormous 377% build up in the cost of a 10-piece set of kitchen towels. For ladies’s clothes the upward push was once 8%.

This follows Donald Trump’s choice to finish the “de minimis” exemption for small programs from mainland China and Hong Kong. which had intended that programs beneath $800 didn’t qualify for any taxes or price lists.

China assured of accomplishing 2025 enlargement goal, says state planner

China’s policymakers are insisting these days that they are going to hit this 12 months’s enlargement goals, in spite of the have an effect on of Donald Trump’s price lists.

The vice head of China’s state planner mentioned on Monday he was once “fully confident” that the arena’s second-largest financial system would succeed in its financial enlargement goal of round 5% for 2025.

Zhao Chenxin, vice chair of the National Development and Reform Commission, instructed a press convention that new insurance policies can be rolled out over the second one quarter, in response to adjustments within the financial state of affairs.

Zhao mentioned:

“The achievements of the primary quarter have laid a cast basis for the commercial construction of the entire 12 months.

No topic how the global state of affairs adjustments, we will be able to anchor our construction objectives, handle strategic focal point and pay attention to doing our personal factor.”

Introduction: US business with China weakening

Good morning, and welcome to our rolling protection of industrial, the monetary markets and the arena financial system.

Donald Trump’s business conflict is weakening the United States financial system and inflicting a plunge in business with China, economists and logistics companies are caution.

Nearly 4 week’s after Trump’s ‘Liberation Day’ announcement of upper price lists brought on a business conflict with Beijing, proof is mounting that companies and customers are chopping again.

Torsten Sløk, leader govt at asset supervisor Apollo Global Management, explains:

For firms, new orders are falling, capex plans are declining, inventories have been emerging sooner than price lists took impact, and corporations are revising down profits expectancies.

For families, client self assurance is at record-low ranges, customers have been front-loading purchases sooner than price lists started, and tourism is slowing, specifically global shuttle.

Sløk has pulled in combination a chartbook highlighting the wear and tear to corporate profits…

…on new orders…

…and particularly on business with China.

A business conflict is a “stagflation shock”, Sløk fears.

He explains that it most often takes between 20 and 40 days for a sea container to shuttle from China to the United States. That implies that the slowdown in container departures from China to the United States which began in early April can be felt at US ports in early and mid-May.

That would hit call for for trucking from mid-May, main to drain cabinets and layoffs in trucking and retail business, inflicting what Sløk dubs “The Voluntary Trade Reset Recession”.

Sløk warned on Friday:

In May, we will be able to start to see important layoffs in trucking, logistics, and retail — specifically in small companies corresponding to your impartial toy retailer, your impartial ironmongery shop, and your impartial males’s outfitter.

With 9 million other folks operating in trucking-related jobs and 16 million other folks operating within the retail sector, the drawback dangers to the financial system are important.

There are indicators these days that this business slowdown is underway, because of the 145% tariff imposed on Chinese imports to the United States.

The Financial Times experiences this morning that the Port of Los Angeles, the primary path of access for items from China, expects scheduled arrivals within the week beginning 4 May to be a 3rd less than a 12 months sooner than.

The new upper price lists introduced on different international locations are these days paused, in fact, whilst the United States negotiates new business offers.

Trump has claimed to Time Magazine that he’s made 200 offers. But this seems to be, neatly, an exaggeration.

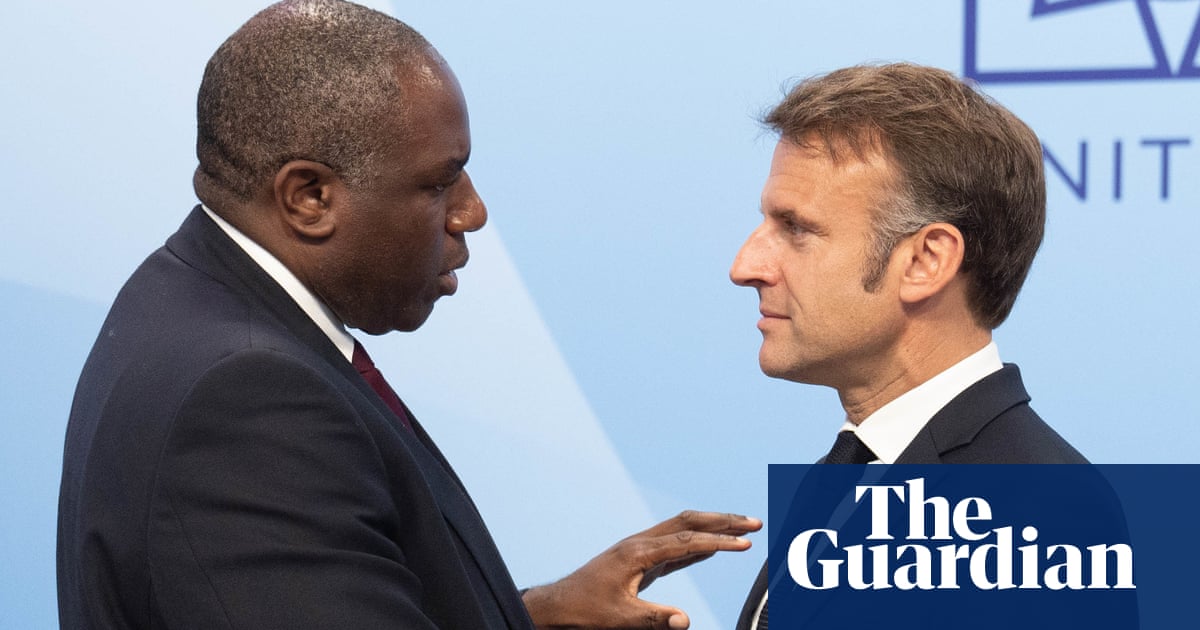

US Treasury secretary Scott Bessent instructed ABC News he believes Trump is “referring to sub deals within the negotiations we’re doing.”

Bessent insisted, although, that growth is being made, arguing:

If there are 180 international locations, there are 18 necessary buying and selling companions, let’s put China to the aspect, as a result of that’s a unique negotiation, there’s 17 necessary buying and selling companions, and now we have a procedure in position, over the following 90 days, to barter with them. Some of the ones are shifting alongside rather well, particularly with the Asian international locations.

Treasury Secretary Scott Bessent defended President Donald Trump’s negotiating technique on business offers however mentioned he did not know whether or not Trump was once talking without delay with Chinese President Xi Jinping. https://t.co/kOqQ2STvOf

— ABC News (@ABC) April 27, 2025

Last week, transport large Hapag-Lloyd reported that its shoppers have cancelled 30% of shipments to the United States from China….and there was a “massive increase” in call for for consignments from Thailand, Cambodia and Vietnam as a substitute.

The schedule

-

11am BST: CBI’s distributive trades survey of UK retailing

-

11am BST: France’s unemployment information for March

-

3.30pm BST: Dallas Fed production index for April

Global News Post Fastest Global News Portal

Global News Post Fastest Global News Portal